Most independent producers don’t have deep pockets. But they do have ideas-lots of them. The problem? Getting one film made is hard. Getting three, five, or seven made? That’s where slate financing comes in. It’s not magic. It’s math. And it’s how smart producers turn scattered projects into a sustainable business.

What Exactly Is Slate Financing?

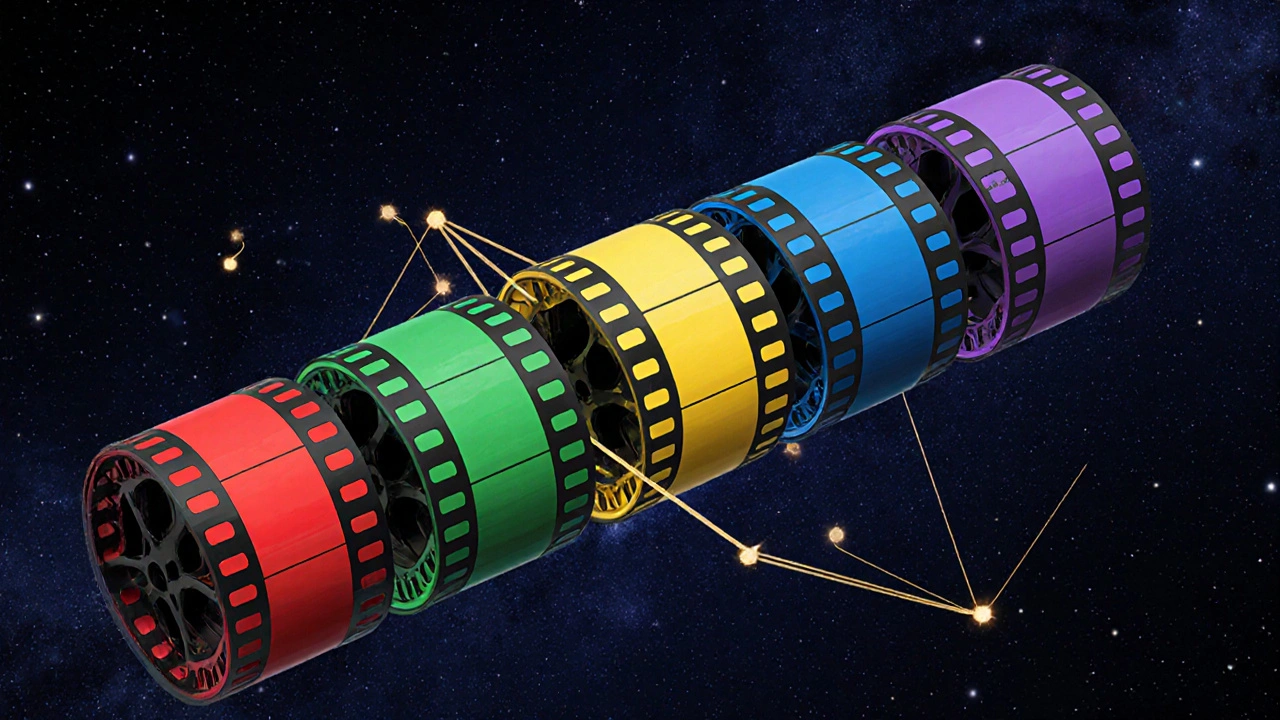

Slate financing means raising one big pool of money to fund multiple films at once. Instead of pitching each movie separately to investors, you bundle them together. Think of it like a mutual fund, but for movies. You’re not betting on one script. You’re betting on a portfolio.

For example, a producer might put together a slate of five films: one low-budget horror, two mid-range dramas, one documentary, and a quirky comedy. Each has different risks and returns. Together, they balance each other out. If the horror film becomes a cult hit, it can cover losses from the documentary that underperformed. That’s the whole point.

This isn’t new. Companies like A24 and Neon built their early reputations using slate deals. But now, even small indie teams are doing it-with the right structure.

Why Producers Are Turning to Slate Financing

Traditional film funding is broken. You spend six months pitching one movie. You get a $2 million commitment. Then you spend another year raising the rest. By the time you shoot, the money’s gone, the cast moved on, and the market shifted.

Slate financing fixes that. Here’s why:

- You lock in funding for 3-7 films at once, reducing fundraising fatigue.

- Investors get exposure to multiple projects, lowering their risk per film.

- You gain leverage. One investor who likes your slate is more likely to back your next one.

- Distribution deals become easier. Buyers want consistent output, not one-off surprises.

A 2024 report from the Independent Film & Television Alliance found that producers using slate structures raised capital 40% faster than those pitching single films. And their films had a 28% higher completion rate.

How to Build a Slate That Investors Actually Want

Not every group of films is a slate. A random collection of scripts won’t cut it. Investors need structure. Here’s what works:

1. Start with 3-7 Projects

Too few? Not enough diversification. Too many? It looks chaotic. Three is the minimum. Seven is the max for first-time producers. Five is the sweet spot.

Each film should have:

- A clear genre

- A realistic budget ($50K-$5M)

- A target audience

- A pre-identified sales agent or distributor

For example: Film A ($800K horror), Film B ($1.2M drama), Film C ($300K documentary), Film D ($1.5M comedy), Film E ($600K thriller). That’s a balanced slate.

2. Assign Risk Levels

Label each film as Low, Medium, or High Risk. Then assign a return expectation:

- Low Risk: $300K-$1M budget. Target 2x-3x return. Think festival darlings with strong streaming appeal.

- Medium Risk: $1M-$3M. Target 3x-5x. These are the ones with known actors or directors.

- High Risk: $3M-$5M. Target 5x-10x. These are the wildcards-maybe a debut director, untested concept, or international co-production.

Investors want to see that you’ve mapped this out. A simple table helps:

| Film Title | Budget | Risk Level | Expected ROI | Distribution Plan |

|---|---|---|---|---|

| Dark Hollow | $800K | Low | 2.5x | Shudder + VOD |

| The Last Train | $1.4M | Medium | 4x | Netflix, international sales |

| Mountains We Forgot | $300K | Low | 3x | PBS, film festivals |

| Beach House | $1.5M | Medium | 5x | Hulu, Amazon |

| Echo Chamber | $4.2M | High | 8x | Netflix, Cannes premiere |

3. Secure Pre-Sales and Gap Financing

Investors don’t want to fund empty scripts. They want proof someone will buy the films.

Get pre-sales agreements-even if they’re small. A $200K pre-sale from a streaming platform on one film reduces the total funding gap. That’s money you can use to attract equity investors.

Gap financing (loans secured against future sales) is common in slates. It lets you use future revenue as collateral. Most banks and specialty lenders require at least two pre-sales to approve gap financing. That’s why slate deals work: they create multiple pre-sale opportunities.

Who Invests in Film Slates?

Not your uncle with a retirement fund. These are professional investors who know the space:

- Private equity funds focused on entertainment (e.g., Elevation Pictures, Creative Artists Agency’s investment arm)

- Family offices with diversified portfolios-some allocate 1-3% to media

- Streaming platforms like Amazon or Apple, who invest to secure exclusive content

- Foreign co-production partners (Canada, UK, Germany) who offer tax credits in exchange for equity

- High-net-worth individuals who’ve made money in film before and want recurring exposure

Don’t cold-call them. You need an introduction. Film festivals like Sundance, TIFF, and Cannes are where these investors look. Build relationships there. Bring your slate deck. Don’t bring your script.

The Hidden Costs and Risks

Slate financing isn’t risk-free. Here’s what can go wrong:

- One film delays everything. If your $4M film gets stuck in post for 18 months, cash flow dries up. The rest of the slate can’t move forward.

- Investors demand control. Some will want approval rights on casting, editing, or even marketing. That can kill creative freedom.

- Recoupment gets messy. If one film makes $10M and another loses $1M, how do you split profits? You need a crystal-clear waterfall structure.

- Market shifts. A genre you bet on (like true crime docs) might collapse overnight. Your slate needs flexibility.

Fix this by:

- Building in buffer time (add 3-6 months to each film’s schedule)

- Limiting investor veto rights to major budget overruns

- Hiring a film accountant who specializes in slate structures

- Keeping at least one film in the slate as a “flexible slot” you can swap out if needed

Real Example: A Small Slate That Worked

In 2023, a producer in Asheville put together a five-film slate with a total budget of $5.1M. Three were micro-budget features ($200K-$500K), one was a $1.8M drama, and one was a $2.1M international co-production with Germany.

They secured:

- $1.2M from a local family office

- $900K in German tax credits

- $700K in pre-sales to a Latin American streaming service

- $1.5M in gap financing secured against future sales

Three films finished on time. Two made a profit. One lost money but got into Sundance, which boosted the whole slate’s profile. The producer raised a second slate in 11 months.

They didn’t have a famous name. They didn’t have Hollywood connections. They had a clear plan, a balanced slate, and proof they could execute.

What to Avoid

Here are the top three mistakes indie producers make with slate financing:

- Overestimating returns. Don’t promise 10x returns on low-budget films. That’s fantasy. Stick to realistic numbers based on genre, platform, and past comps.

- Skipping legal structure. You need an LLC or LP with a detailed operating agreement. Define profit splits, recoupment order, and exit clauses. Hire a film lawyer-don’t use a template from Etsy.

- Trying to do it alone. Slate financing requires a team: a producer, a line producer, a financial advisor, and a sales agent. You can’t wear all those hats.

Where to Start Today

If you’re ready to build a slate, here’s your action plan:

- Write down 5-7 film ideas with budgets and genres.

- Research recent sales of similar films on IMDbPro or Box Office Mojo. What did they earn? Who bought them?

- Reach out to 3-5 sales agents. Ask for feedback on your slate. Most will respond if you’re professional.

- Build a one-page slate deck: title, budget, risk level, ROI, distributor. No scripts. No photos. Just facts.

- Attend a film market (AFM, Cannes, or even virtual ones like NFFTY). Talk to 10 investors. Don’t ask for money. Ask for advice.

Slate financing isn’t about luck. It’s about discipline. It’s about treating your films like a business-not a hobby. The ones who win aren’t the ones with the best script. They’re the ones who built a system that works, even when one film fails.

Can I use slate financing if I’ve never made a film before?

Yes, but you need proof you can deliver. Investors care more about your team’s track record than your personal film history. If you’ve produced shorts, commercials, or even successful web series, use that. Show you’ve managed budgets, met deadlines, and delivered quality. A strong line producer and experienced sales agent can also back your credibility.

How long does it take to raise slate financing?

On average, it takes 6-12 months. That’s longer than raising money for one film, but you get funding for multiple projects at once. The key is preparation. If your slate deck is polished, your budget numbers are realistic, and you’ve already lined up pre-sales, you can close in under 4 months.

Do I need a U.S.-based company to get slate financing?

No. Many international producers use slate structures. But if you’re targeting U.S. investors, you’ll need a U.S. legal entity-usually an LLC or LP. Foreign investors often prefer to invest through a U.S. structure to avoid complex tax reporting. It’s easier to set up than you think. A film attorney can help you do it for under $5,000.

What’s the minimum budget for a slate to be attractive to investors?

There’s no official minimum, but investors typically look for slates with at least $3M in total funding. Smaller slates ($1M-$2M) exist, but they’re harder to sell because the overhead of managing multiple films eats into returns. If your total slate is under $2M, consider partnering with another producer to scale up.

Can I include documentaries in a slate?

Absolutely. Documentaries are low-risk, low-budget, and often attract grants, public funding, and educational distributors. They’re perfect for balancing out higher-risk narrative films. Many successful slates include one or two docs to stabilize returns and qualify for tax credits.

Comments(9)