Getting money for a film isn’t about charisma or big dreams. It’s about proving you’ve thought through every detail - and that you can deliver. Investors don’t fund ideas. They fund packages. And the package? It’s made of three things: a film lookbook, a pitch deck, and financials. Get any one wrong, and the deal dies.

Why the Lookbook Comes First

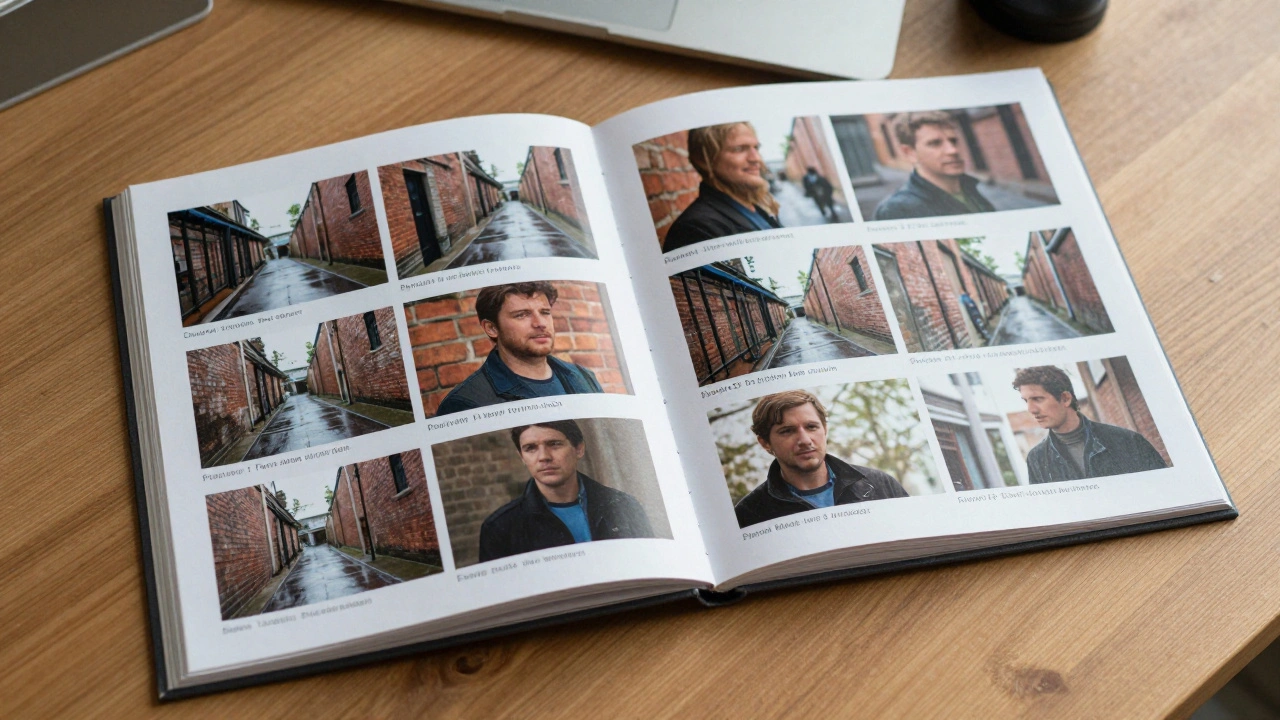

The lookbook isn’t a mood board. It’s not just pretty photos. It’s a visual contract. It tells investors what the movie will actually look like on screen - not what you imagine, but what’s achievable.Top indie producers start with real location scouts, costume tests, and actor headshots. Not stock photos. Not AI renders. Real shots from test shoots or similar past projects. A lookbook from The Last Black Man in San Francisco used 17 actual frames from early tests, each labeled with camera lens, lighting setup, and color grade. That’s the standard.

Investors need to see texture. The grit on a brick wall. The way light hits an actor’s face in a rainy alley. If your lookbook has more than three generic images, you’re wasting space. Every image must answer: Does this prove we know how to shoot this?

The Pitch Deck: Less Talk, More Proof

Most pitch decks are just slides with buzzwords: "This is the next Get Out!" or "Targeting Gen Z audiences!" That’s noise. Investors hear that every week.What works? A 10-slide deck that answers three questions:

- What’s the story? (One sentence. No loglines.)

- Who’s already on board? (Cast, director, key crew - with credits.)

- Who’s already paying? (Pre-sales, tax credits, grants secured.)

Don’t list your film festival dreams. List actual deals. If you’ve signed a distribution agreement with a platform like MUBI or Shudder, say it. If you’ve locked in a Canadian tax credit worth $180,000, show the letter. If your lead actor has a 500K Instagram following and you’ve got proof of their willingness to promote the film, include that screenshot.

The rest? Cut it. No bios. No mission statements. No "Why Now?" slides. Investors don’t care about your passion. They care about your leverage.

Financials: The Only Part That Can’t Be Faked

This is where most indie films fail. Producers think they can guess numbers. They can’t.A real film financial model includes:

- Line-item budget broken down by department (camera, sound, post, insurance, legal)

- Source of every dollar: equity, pre-sales, grants, tax credits

- Revenue projections: domestic, international, streaming, VOD, ancillary

- Waterfall distribution: who gets paid when, and how much

Use real numbers. Not estimates. If you’re shooting in Georgia, use the Georgia Department of Economic Development’s 2025 incentive rate: 30% base + 10% for filming in a qualified zone. That’s 40%. Don’t say "we expect incentives." Show the exact amount: $220,000 from Georgia Film Office, confirmed in writing.

Revenue projections? Base them on comparable films. Not Barbie. Not Oppenheimer. Look at films with similar budgets, genres, and cast profiles. For example: The Killing of a Sacred Deer (budget: $3.5M) earned $8.2M globally. That’s your benchmark, not a fantasy.

And never forget: investors want to know their exit. How and when will they get their money back? Include a simple waterfall chart showing cash flow. If your film earns $5M, show exactly how much goes to investors, producers, talent, and distributors. No vague promises.

Putting It All Together

The best pitch packages don’t feel like a presentation. They feel like a file you’d find in a studio executive’s desk drawer - clean, quiet, and complete.Here’s how to assemble it:

- Start with the lookbook. Print it as a 10-page, matte-finish booklet. No glossy. No fluff. Just images and captions.

- Then the deck. PDF, under 10MB. One page per slide. No animations. No transitions.

- Then the financials. Excel file, locked, with formulas visible. No passwords. Include a one-page summary PDF.

- Bind it all in a simple folder. No logo. No ribbon. No "Produced by" taglines.

Send it as a link: Google Drive or Dropbox. Not WeTransfer. Not email attachments. Investors are busy. Make it easy to open, scroll, and download.

What Kills a Pitch - Fast

Here’s what turns investors off:- Using "we’re looking for $500K to finish" without showing how the first $300K will be spent.

- Having no cast attached, or worse - attaching actors who don’t have IMDb credits.

- Listing "Netflix" as a target distributor without any pre-sale or letter of intent.

- Using a budget that doesn’t match the lookbook. If your lookbook shows a $20K production design, your budget can’t be $50K.

- Missing insurance. No producer’s liability insurance? You’re not ready.

One producer in Nashville lost a $1.2M deal because her budget didn’t include post-production sound mixing. The investor asked: "Where’s the re-recording budget?" She said, "We’ll do it in a garage." The deal ended.

Real Examples That Closed Deals

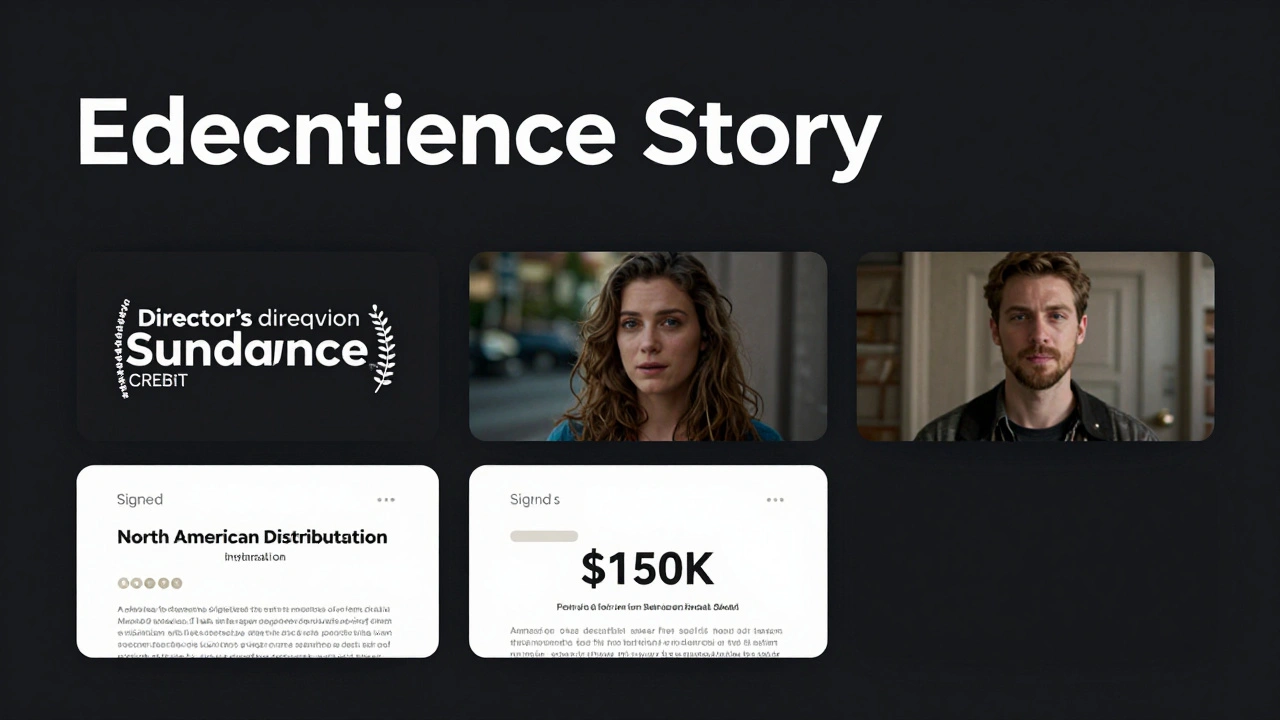

In 2024, a low-budget horror film called Quiet House raised $450,000 from seven investors. Their lookbook had 12 real photos from a 3-day shoot in rural Tennessee. The deck had two slides: one with the director’s credits (including a Sundance short), and one with a signed letter from a distributor offering $150K for North American rights. The financials showed $300K in Tennessee tax credits already approved.Another film, Red Line, raised $800K because their financial model included a clear recoupment schedule: investors get 100% of first $1M, then 70% after that. No ambiguity. No "we’ll talk later." That’s what made them trustworthy.

Final Rule: Don’t Pitch Until You’re Ready

Too many filmmakers rush. They think if they just get in front of an investor, magic will happen. It won’t.Wait until you have:

- At least one key cast member confirmed

- One distribution lead or pre-sale

- A budget that matches your lookbook

- Proof of tax credits or grants

- A financial model that shows how investors get paid

If you don’t have those, go make them. Shoot a test scene. Talk to a distributor. Apply for a grant. Fix your budget. Don’t pitch until your materials feel like a real business plan - not a hopeful letter.

Film financing isn’t about passion. It’s about proof. And the right materials? They’re the only thing that turns "maybe" into "yes."

Do I need a famous director to get investors?

No. Investors care more about track record than fame. A director who won a prize at Slamdance or Sundance Shorts has more credibility than a big-name director with no recent credits. Prove you’ve made something before - even if it was short or low-budget.

Can I use AI-generated images in my lookbook?

Avoid them. Investors know AI art. They’ve seen it. And they assume you’re cutting corners. If you can’t afford a real shoot, use stills from similar films you’ve referenced - with proper credit. Authenticity beats polish every time.

How detailed should the financials be?

Detail matters. Every line item should be traceable. If you list "costumes: $12,000," show the quote from the costume house. If you list "travel: $8,500," include flight and lodging estimates. Investors want to see that you’ve done the homework - not guessed.

What if I don’t have any pre-sales yet?

Then focus on grants and tax credits. Many states offer production incentives - Georgia, New Mexico, Louisiana. Apply for them before pitching. A confirmed $150K tax credit is more convincing than a vague "we’re targeting streaming." Use it as leverage.

Should I send the pitch package to everyone at once?

No. Target 5-10 investors who’ve funded similar films. Check their past credits on IMDbPro. Send the package only after you’ve sent a short, personalized email explaining why your film fits their portfolio. Cold blasts get ignored.

Is a pitch deck still necessary if I have a lookbook and financials?

Yes. The lookbook shows what it looks like. The financials show how it works. The deck shows who’s behind it. Investors need to know the team is capable. Without the deck, you’re just a budget with pretty pictures.

Comments(8)