When a film gets made, money doesn’t just flow in one direction. It moves through layers-investors, distributors, talent, vendors-and every dollar has to be tracked, collected, and paid out correctly. That’s where Collections Accounts Management comes in. Without it, even successful films can end up in financial chaos. CAM agreements are the legal backbone that makes sure the money goes where it’s supposed to go, when it’s supposed to go there.

What Exactly Is a CAM Agreement?

A Collections Accounts Management (CAM) agreement is a contract between a film production company and a third-party financial agent. This agent handles all incoming revenue from box office sales, streaming deals, TV rights, merchandise, and international licensing. The agent doesn’t make creative decisions. They don’t decide how much to spend on marketing. They just make sure every dollar that comes in gets recorded, allocated, and distributed according to the film’s financing structure.

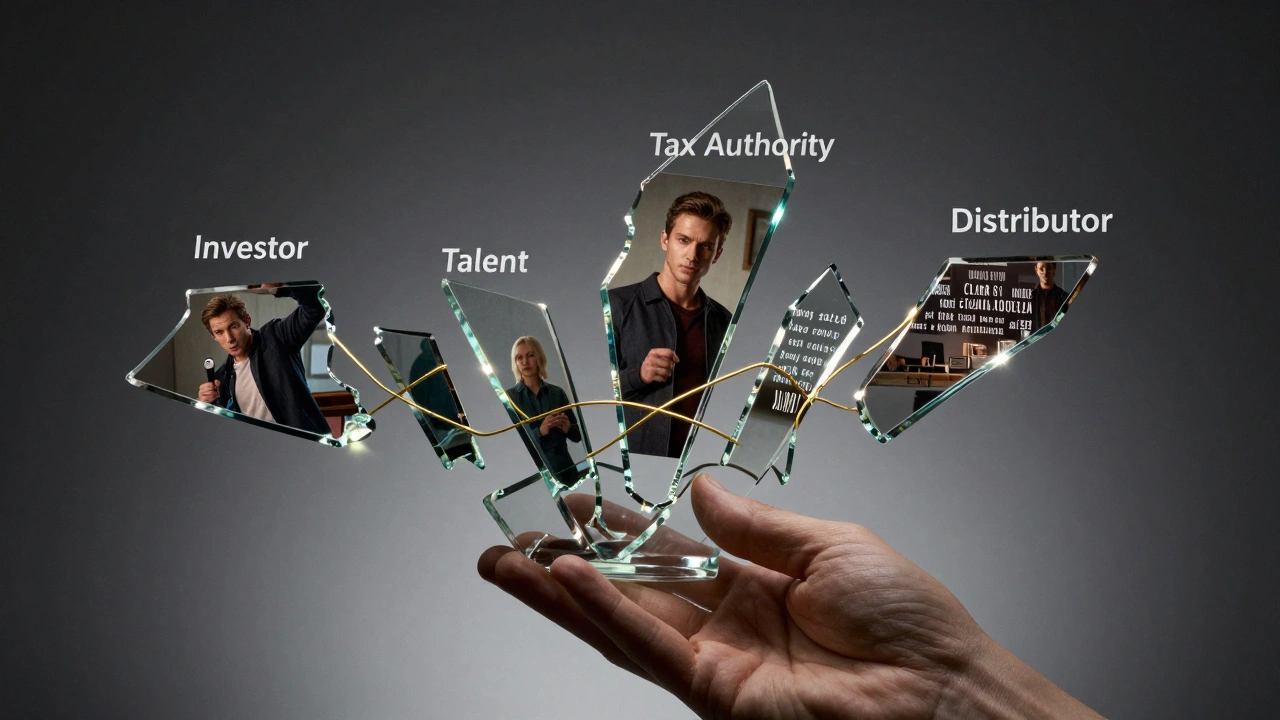

Think of it like a toll booth for film money. Every payment-whether it’s $500 from a small streaming platform in Brazil or $2 million from Netflix-goes through the CAM agent. They track it, verify it, and then send the right portions to the right people: investors, producers, talent, tax authorities, and more.

Without a CAM agreement, a producer might get a check from a distributor and then have to manually split it among 15 different parties. One missed payment. One wrong calculation. One late tax filing. And suddenly, someone’s lawsuit is in the mail.

Why Do Films Need CAM Agreements?

Most independent films are financed with money from multiple sources. Maybe a private investor put in $500,000. A tax credit program in Canada covered $300,000. A European broadcaster paid $200,000 upfront for broadcast rights. And now, the film just sold to a U.S. streaming service for $1.2 million.

Each of those sources has its own rules. The Canadian tax credit requires proof of spending in Quebec. The European broadcaster wants a 15% share of net profits. The private investor gets paid back first, then shares 30% of residuals. The director gets a percentage of box office gross. The composer gets a royalty from streaming plays.

Trying to manage all that manually? It’s impossible. Mistakes happen. Payments get delayed. Disputes flare up. CAM agreements solve this by making one entity-the collections agent-responsible for the entire money flow. They have the systems, the legal templates, and the experience to handle this complexity without error.

How CAM Agreements Protect Investors

Investors in film don’t just want a return. They want proof. They want transparency. They want to know their money isn’t being lost in the shuffle.

A good CAM agreement gives investors direct access to real-time revenue reports. They can log in to a secure portal and see exactly how much the film earned last month, what percentage was paid out, and who got what. No more asking, “Did we get paid yet?”-they just check.

Some CAM providers even offer audit rights. If an investor suspects something’s off, they can request a full accounting of all receipts and disbursements. That’s a powerful deterrent against fraud or mismanagement.

In 2023, a mid-budget indie film in the U.S. had a $1.8 million revenue stream from international sales. Without a CAM agreement, the producer handled payments directly. Three months later, two investors discovered they hadn’t been paid. One had to hire a lawyer. The other walked away from future projects. The film made money. But the trust was broken.

How CAM Agreements Handle Multiple Revenue Streams

Modern films earn money in dozens of ways. Here’s a typical breakdown:

- Box office gross (theatrical releases)

- Streaming licensing (Netflix, Hulu, Amazon)

- TV broadcast rights (cable, network, international)

- DVD/Blu-ray sales (still a thing in some markets)

- Merchandising and licensing

- Foreign sales (via sales agents)

- Public performance rights (schools, airlines, hotels)

- Music publishing royalties

- Tax credits and rebates

Each of these streams has different payment timelines, reporting formats, and payout structures. Box office reports come weekly. Streaming deals pay quarterly. Tax credits can take 18 months to process. Foreign sales agents send checks in euros, yen, or pounds.

A CAM agent converts everything into a single currency. They reconcile every report. They match payments to contracts. They apply the correct deductions-commissions, fees, taxes-and then distribute the rest according to the film’s waterfall structure.

That waterfall is key. It’s the order of who gets paid first. Investors get repaid first. Then the producers. Then talent with backend deals. Then the rest. The CAM agent doesn’t decide this-they just follow the contract. That’s what makes them neutral and trustworthy.

The Role of the CAM Agent: Not a Middleman, But a Trustee

Some people think the CAM agent is just another vendor. They’re wrong. A CAM agent acts as a fiduciary. That means they have a legal duty to act in the best interest of everyone involved-not just the producer.

They don’t take sides. If a distributor underpays, the CAM agent flags it. If a talent agent claims a higher percentage than the contract says, the CAM agent checks the paperwork. If a tax authority demands a payment, the CAM agent pays it on time.

They also handle escrow accounts. Some financing deals require money to be held in trust until certain conditions are met-like a film winning an award or hitting a box office target. The CAM agent holds that money, releases it only when the conditions are verified, and documents every step.

Top CAM providers like Entertainment Financial Services (a leading provider of financial services for film and television productions) and Media Finance Group (a global collections and accounting firm specializing in entertainment revenue management) have been doing this for over 20 years. They’ve processed over $12 billion in film revenue combined. They know how to handle everything from a low-budget documentary to a $100 million franchise film.

What Happens Without a CAM Agreement?

It’s not just messy. It’s risky.

One 2024 case involved a documentary that earned $750,000 from streaming and TV sales. The producer, a first-time filmmaker, handled all payments personally. They paid themselves first. Then the editor. Then the composer. But they forgot about the investor who had a 40% share. Six months later, the investor sued. The film’s revenue was frozen during litigation. The producer lost their license to produce films in three states.

Another film had a $3 million distribution deal with a company in Spain. The producer didn’t use a CAM agent. The distributor claimed the film didn’t meet their “minimum screen count” clause and withheld 30% of the payment. The producer didn’t have the records to prove otherwise. The money was gone.

These aren’t rare. They happen every year. And they’re preventable.

How to Choose the Right CAM Provider

Not all CAM services are the same. Here’s what to look for:

- Experience with your film type: A documentary needs different handling than a studio action movie.

- Transparency: Do they offer real-time dashboards? Can you download monthly reports?

- Global reach: If your film sells internationally, the agent must handle foreign currencies, tax treaties, and local reporting rules.

- Legal backing: Do they have audit rights and dispute resolution protocols built in?

- Fees: Most charge 3% to 5% of gross collections. Anything higher is a red flag.

Ask for references. Talk to other producers. Check if they’ve worked with films similar to yours. Don’t go with the cheapest option. Go with the most reliable.

Final Thought: CAM Isn’t a Cost. It’s Insurance.

Think of a CAM agreement like liability insurance for your film’s money. You don’t hope for an accident-you prepare for it. You don’t skip insurance because it’s expensive. You pay for it because you can’t afford not to.

A $10,000 CAM fee on a $2 million film isn’t a cost. It’s protection. It’s peace of mind. It’s what keeps your investors from walking away, your talent from suing, and your reputation from crumbling.

When the credits roll, the money should be flowing-not fighting.

What does a CAM agent actually do with the money?

A CAM agent receives all incoming revenue from distributors, streaming platforms, and licensors. They record every payment, verify it against contracts, deduct agreed-upon fees and taxes, and then distribute the remaining funds according to the film’s predefined payment waterfall. They don’t decide who gets paid-they just follow the legal agreement.

Can I handle collections myself instead of hiring a CAM agent?

You can, but it’s risky. Most filmmakers who try this end up making errors in tracking, missing deadlines, or misallocating funds. Even one mistake can trigger investor disputes, tax penalties, or legal action. CAM agents have specialized software, legal teams, and decades of experience handling complex revenue structures-something most producers don’t have.

Are CAM agreements only for big-budget films?

No. CAM agreements are essential for any film with multiple investors, international sales, or complex financing. Even low-budget documentaries with tax credits and crowdfunding backers benefit from a CAM agreement. It’s not about the budget-it’s about how many people have a financial stake in the film.

How long does a CAM agreement last?

A CAM agreement typically lasts as long as the film generates revenue-often 7 to 10 years, sometimes longer. Most agreements are tied to the film’s copyright term or the duration of its distribution rights. Payments can continue for years after release, especially from streaming and international TV.

What happens if the CAM agent goes out of business?

Reputable CAM providers hold client funds in segregated trust accounts, separate from their own operating funds. If they go under, those funds are protected and transferred to a new agent. Always confirm the provider uses third-party trust accounts and has professional liability insurance.

Do CAM agents handle tax filings?

Yes, many do. They prepare and file withholding tax forms for international payments, manage tax credit applications, and issue 1099s to U.S. recipients. Some even work with accountants to provide year-end tax packages for investors. This is a major value-add, especially for films with global revenue.

Next steps: If you’re financing a film, talk to your lawyer and producer about including a CAM agreement in your financing package. Don’t wait until the money starts coming in. Set it up before production begins.

For filmmakers, this isn’t about bureaucracy. It’s about protecting your film’s future-and your relationships with everyone who helped make it possible.

Comments(10)