Why does Netflix greenlight a third season of Stranger Things but cancel The OA after two? Why did The Boys get a fourth season while Altered Carbon vanished after three? It’s not about ratings alone. It’s not about buzz. It’s about data, money, and long-term franchise building - and streamers are playing a very different game than traditional studios.

It’s Not About Viewership Anymore

For years, studios judged success by Nielsen ratings or box office numbers. Streamers don’t care about those anymore. They track something deeper: completion rates. If 70% of people who start Season 1 of Wednesday finish it, that’s a win - even if only 10 million households watched the first episode. Netflix revealed in 2023 that shows with completion rates above 65% are 3x more likely to get renewed. That’s why Outer Range got a second season despite modest total viewership - people who started it, stuck with it.

It’s not just about how many watch. It’s about how deep they go. A show with a slow burn, like Severance, might have lower initial numbers but higher retention. That’s gold for streamers. They’re not selling ads - they’re selling subscriptions. And subscriptions stick when viewers feel hooked on a universe, not just a single season.

The Franchise Play: Building Universes, Not Just Shows

Amazon didn’t renew The Boys because it was popular. They renewed it because it became a franchise engine. Spinoffs like Gen V and The Boys: Diabolical feed the main show. Each new piece keeps the IP alive, drives discovery, and pulls new subscribers into the ecosystem. It’s the same strategy Disney+ uses with Star Wars - Andor isn’t just a show. It’s a bridge to Rebels, Ahsoka, and future movies.

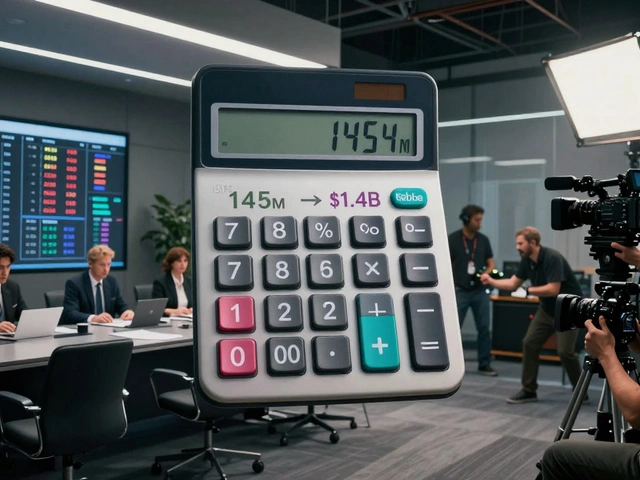

Netflix’s Stranger Things is the textbook example. It’s not just a show. It’s a merchandising machine, a theme park attraction, a video game, and a music catalog. Renewing it isn’t about TV ratings - it’s about keeping the entire machine running. One season costs $30 million per episode. But the licensing revenue from toys, apparel, and soundtracks? That’s over $200 million annually.

Streamers now think in decades, not seasons. They’re building IP portfolios like movie studios did in the 1980s - except now, they own the whole pipeline: production, distribution, merch, and fan engagement.

Renewal Signals: What Gets Greenlit

There are five clear signals streamers look for before renewing a show:

- Completion rate above 65% - If people finish it, they’re invested.

- Global reach - A show that performs well in Brazil, India, and Germany gets priority over one that only does well in the U.S.

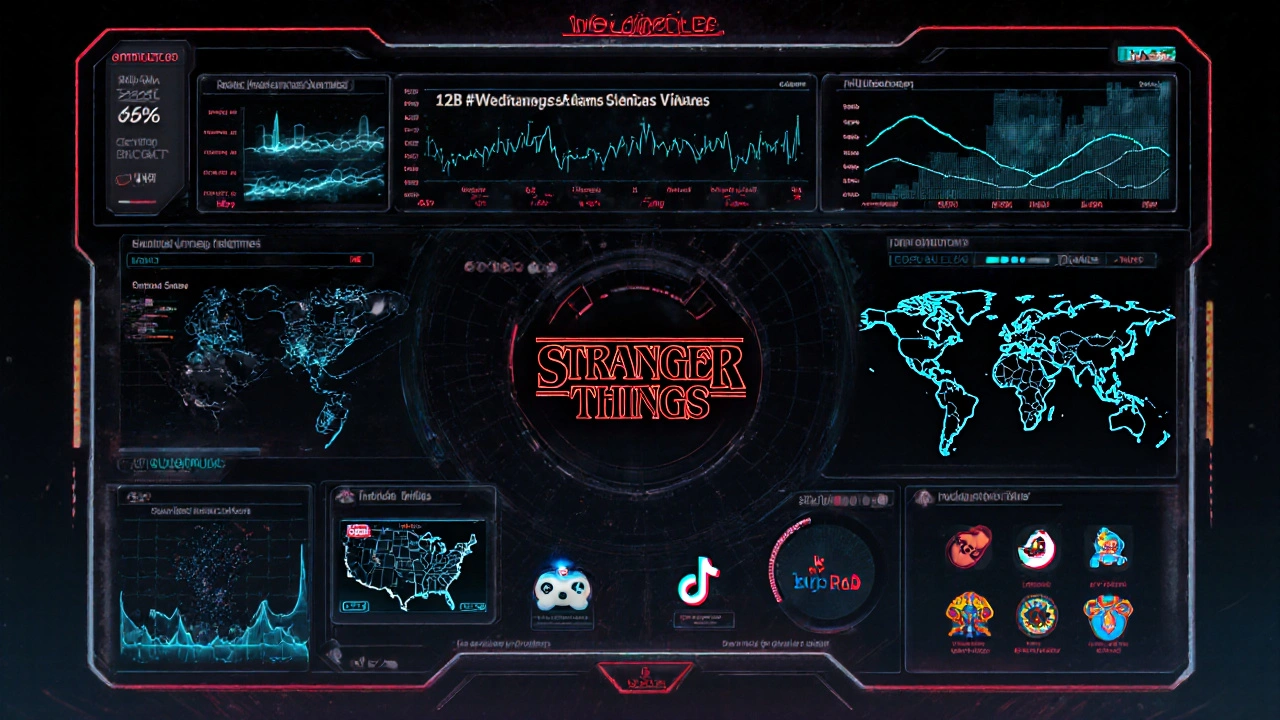

- Social media chatter - TikTok trends, Reddit threads, and meme culture matter more than critic reviews.

- Production pipeline readiness - If the writers’ room is already drafting Season 3 and the cast is available, renewal is almost guaranteed.

- Franchise potential - Can this become a spinoff? A movie? A game? A comic?

Take Wednesday. It had a 78% completion rate, broke TikTok records with 12 billion views of #WednesdayAddams, and had Tim Burton already attached to a potential movie. Renewal was inevitable.

On the flip side, 1899 had decent reviews and a cult following. But its completion rate was under 40%. It didn’t trend globally. No spinoff ideas. It got canceled after one season - no drama, no warning.

Why Some Sequels Die - Even When Fans Beg

There’s a myth that fan campaigns save shows. They don’t. Not anymore. In 2024, over 1.2 million people signed petitions to bring back The Good Place on Netflix. It didn’t happen. Why? Because the rights are owned by NBCUniversal, not Netflix. And the creators moved on. No cast availability. No production infrastructure. No financial incentive.

Another reason: creative burnout. House of Cards was renewed for six seasons. But after Kevin Spacey left and the story lost its edge, viewership dropped 40% in Season 6. Netflix didn’t cancel it because of backlash - they canceled it because the show had become a financial drain with diminishing returns.

And then there’s the cost problem. A single season of Stranger Things costs $30 million per episode. That’s $300 million for Season 5. If the next season doesn’t drive a measurable spike in new sign-ups or reduce churn, it’s not worth it. Streamers don’t care about legacy. They care about ROI.

How Studios Are Adapting - And Failing

Traditional studios are scrambling to catch up. Warner Bros. tried to revive Titans as a Netflix-style franchise with spinoffs and movies. It flopped. Why? They didn’t build the infrastructure. They didn’t track completion rates. They didn’t use data to guide storytelling.

Apple TV+ took a different route with Severance. They didn’t rush a Season 2. They waited two years. They hired new writers. They expanded the world. They released a companion podcast and an interactive website. When Season 2 dropped, it didn’t just return - it exploded. Viewership jumped 120% from Season 1. Why? Because they treated it like a franchise, not a TV show.

Meanwhile, Hulu’s The Handmaid’s Tale is still going strong - not because it’s the most watched, but because it’s the most discussed. It’s a cultural event. Every season drop trends on Twitter. It drives subscriptions. It’s a flagship.

What Comes Next: The Franchise Arms Race

By 2026, streamers will be competing not on how many shows they release - but on how many universes they control. Disney+ already has Marvel, Star Wars, Pixar, and National Geographic. Netflix has Stranger Things, The Witcher, and the upcoming Castlevania universe. Amazon has The Lord of the Rings, The Boys, and The Rings of Power.

Smaller players like Peacock and Paramount+ are trying to piggyback on legacy IP - Law & Order, Star Trek - because they don’t have original franchises to fall back on. It’s a risky move. Fans are tired of reboots. They want new worlds, not recycled ones.

The winners will be the ones who treat sequels like living ecosystems. Not just more episodes - but books, games, AR experiences, and live events. The next big renewal won’t be announced with a press release. It’ll be teased in a hidden Easter egg in a game, then confirmed in a TikTok filter.

What This Means for Viewers

As a viewer, your job isn’t just to watch. It’s to engage. Watch all episodes. Talk about it. Make memes. Share clips. Join fan groups. That’s how you influence renewal - not petitions. Streamers track engagement, not outrage.

If you love a show, don’t wait for it to come back. Help it live. That’s the new contract: you give them your attention, they give you more of what you love.

Why do some shows get renewed even with low viewership?

Shows with high completion rates - where most viewers watch all episodes - are more valuable than those with high initial views but low retention. Streamers care about subscriber retention, not just eyeballs. A show like Severance had modest viewership but a 75% completion rate, making it a prime candidate for renewal.

Do fan petitions work to save canceled shows?

No. Fan campaigns rarely influence renewal decisions. Streamers rely on data: completion rates, global reach, social engagement, and production readiness. Even with millions of signatures, if the cast is unavailable, the writers moved on, or the show isn’t driving new subscriptions, it won’t be brought back.

What’s the difference between a sequel and a franchise?

A sequel is just another season or movie in the same story. A franchise is a whole ecosystem - spinoffs, games, merchandise, comics, and live experiences. Stranger Things is a franchise. Orange Is the New Black was a sequel series. One builds long-term value; the other is a one-off hit.

Why do some franchises get canceled after one season?

Even big-budget shows can be canceled if they don’t meet key metrics: low completion rate, poor global performance, no spinoff potential, or high production cost without matching subscriber growth. 1899 and The Society both had strong concepts but failed on data-driven metrics.

Is it better to watch shows on one platform or spread across services?

It depends on your goals. If you want to support a show’s renewal, binge it on the platform it’s on. That boosts its completion rate and engagement metrics. Spreading views across services doesn’t help - streamers only track data from their own apps. To make a show successful, you need to watch it where it lives.

Comments(5)