Netflix charges $15 a month. Hulu runs ads. Disney+ lets you skip commercials if you pay extra. Amazon Prime Video throws in free movies with your membership. These aren’t just different user experiences-they’re completely different business models. And the money behind them? It’s not what you think.

What AVOD and SVOD Really Mean

AVOD stands for ad-supported video on demand. Think YouTube, Tubi, or Pluto TV. You watch a movie or show, and every 10 to 15 minutes, an ad pops up. The streamer doesn’t charge you anything. Instead, they sell those minutes of your attention to brands. The more people watching, the more they earn.

SVOD means subscription video on demand. That’s Netflix, Apple TV+, Max, and Disney+. You pay a monthly fee-usually $10 to $20-and get unlimited access. No ads. No pay-per-view. Just hit play and go.

Both models rely on films to attract viewers. But how they make money from those films? Totally different.

How AVOD Makes Money from Films

AVOD platforms don’t buy films to own them. They license them cheaply-sometimes for pennies per view. A 2023 report from Ampere Analysis found that AVOD distributors paid an average of $0.15 to $0.40 per stream for older movies. New releases? Rarely. AVODs mostly use films that are 2 to 10 years old.

Why? Because those films are already proven. They’ve had their theatrical run. They’ve been on DVD. They’ve been on other streaming services. Their audience is known. That makes them low-risk, low-cost inventory.

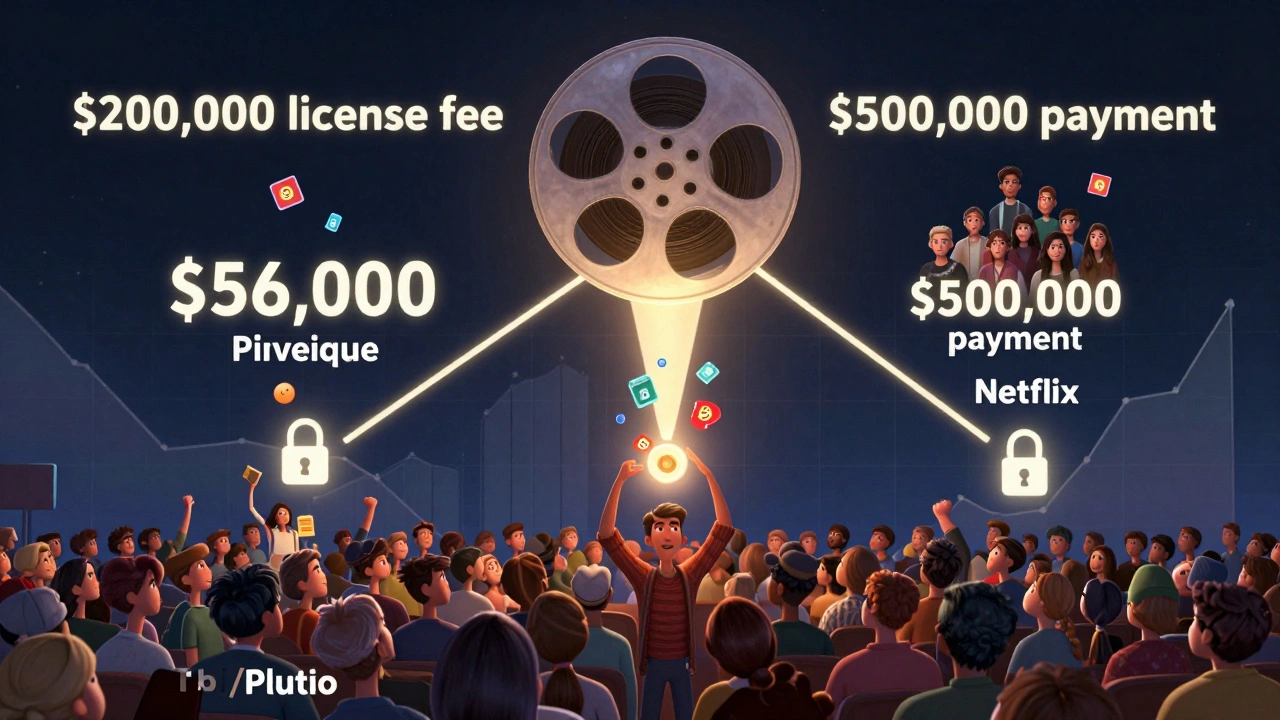

Now, the real money comes from ads. In 2025, the average CPM (cost per thousand impressions) for streaming video ads in the U.S. is $28. That means if 1 million people watch a movie on Tubi, and each person sees two ads during it, the platform earns about $56,000 from that single film.

But here’s the catch: not everyone watches the whole thing. Studies show 30% of AVOD viewers skip or fast-forward through ads. And 40% tune out after the first commercial break. So the real revenue per stream is often half of what the CPM suggests.

Still, because the licensing cost is so low, AVODs make a profit even if only 1 in 5 viewers watches the full movie. A film that costs $10,000 to license and gets 500,000 streams can earn $70,000 in ad revenue. That’s a 600% return.

How SVOD Makes Money from Films

SVODs don’t make money from ads. They make money from subscriptions. That means every film they add has to pull in enough subscribers to justify its cost.

Here’s how it works: Netflix spends $100 million on a new original movie. That includes production, marketing, and licensing fees. They need to keep enough subscribers from churning-meaning they cancel their subscription-because the movie didn’t live up to expectations.

There’s no direct link between how many people watch a movie and how much money Netflix makes from it. If 20 million people watch the film, but 500,000 cancel their subscriptions because they think Netflix is too expensive, the studio lost money.

So SVODs measure success differently. They don’t track views. They track engagement. Did people watch the first 10 minutes? Did they finish it? Did they watch another show right after? Did they recommend it to a friend?

According to internal data leaked in 2024, Netflix considers a film a success if it reaches 15 million households in its first 28 days. That’s not about revenue-it’s about retention. A single hit film can delay subscriber churn for months.

But here’s the problem: original films cost more every year. In 2020, the average SVOD film budget was $25 million. In 2025, it’s $75 million. Meanwhile, subscriber growth has flatlined. Netflix added just 1.2 million new subscribers in Q3 2025-their lowest gain in five years.

That’s why SVODs are cutting back. Apple TV+ canceled 12 original films in 2025. Disney+ stopped greenlighting mid-budget movies. They’re shifting to TV shows, documentaries, and licensed content that costs less and still keeps people subscribed.

The Real Difference: Risk vs. Scale

AVOD is a volume game. You need millions of viewers, but you can afford to lose money on most films. You only need a few hits to cover costs.

SVOD is a bet-the-company game. One flop doesn’t hurt. But three in a row? That’s when subscribers start leaving.

AVODs can afford to stream 500 movies a month. SVODs can only afford to release 10 to 15 originals a year.

That’s why AVOD platforms are growing faster. In 2025, AVOD viewing hours in the U.S. jumped 32% year-over-year. SVOD viewing hours rose just 4%.

Why? Because AVOD is free. And in a time when 68% of U.S. households say they’re cutting back on streaming subscriptions, free is powerful.

Hybrid Models Are the New Normal

Most streamers aren’t just AVOD or SVOD anymore. They’re both.

Paramount+ offers a $9.99 ad-supported tier and a $14.99 ad-free tier. Hulu has a $9.99 plan with ads and a $18.99 plan without. Even Apple TV+ now lets you rent movies with ads for $1.99.

This isn’t a backup plan-it’s the future. Consumers want choice. Some want no ads. Some want no bills. Streamers are building two revenue streams from the same library of films.

Here’s the math: A film licensed for $200,000 can be sold to an SVOD for $500,000. But if it’s also sold to an AVOD for $100,000, the studio makes $600,000. And the streamer gets to charge two different types of users for the same content.

That’s why studios are now releasing films simultaneously on AVOD and SVOD. It’s not piracy. It’s strategy.

Who Wins and Who Loses

Big studios win. They license films to multiple platforms. They get paid upfront. They don’t care if you watch it on Pluto or Netflix.

Independent filmmakers? They’re squeezed. Most don’t have the leverage to negotiate deals with both AVOD and SVOD. They sell their film to one distributor, who then flips it to multiple platforms. The filmmaker gets $10,000. The distributor gets $500,000.

Viewers win too. More choices. Lower prices. More content. But they’re also getting more ads. And more confusion. Which service has what? Why does the same movie cost $5 on one app and $12 on another?

And what about the long-term? If AVOD becomes the default, will films become just ad-filled filler? Will studios stop making bold, risky movies because they can’t get paid enough?

Right now, AVOD is eating SVOD’s lunch. But SVOD still controls the big names: Oscar winners, franchise sequels, and celebrity-led dramas. As long as those exist, people will pay. But if AVOD starts producing its own hit originals-like Amazon’s The Boys or Netflix’s Stranger Things-the balance could shift.

What’s Next?

AVOD is growing because it’s cheap, accessible, and works on any device-even old smart TVs. SVOD is shrinking because it’s expensive, repetitive, and people are tired of paying for five services.

By 2027, analysts predict AVOD will account for 45% of all U.S. streaming revenue. SVOD will drop to 50%.

That doesn’t mean SVOD is dead. It means it’s changing. The winners will be the ones who offer value-not just content. Bundles. Live events. Exclusive behind-the-scenes. Community features. Maybe even a hybrid model where you pay $5 a month and get 10 minutes of ads per hour.

The real question isn’t whether AVOD or SVOD is better. It’s whether you’re willing to trade money for time-or time for money.

Is AVOD cheaper for streamers than SVOD?

Yes, in terms of upfront cost. AVOD platforms pay far less to license films-often under $1 per stream-because they rely on ad revenue, not subscriptions. SVODs pay millions per film to secure exclusivity and keep subscribers. But AVODs need massive audiences to make it work. SVODs need fewer viewers but higher loyalty.

Why do some movies appear on both AVOD and SVOD?

Studios license the same film to multiple platforms to maximize revenue. A movie might premiere on Netflix for subscribers, then move to Tubi for ad-supported viewers after 60 days. This is called windowing. It lets studios earn from both paying and non-paying audiences without giving away exclusivity.

Do AVODs show better films than SVODs?

Not usually. AVODs mostly carry older, lower-budget films that have already had their theatrical and SVOD runs. SVODs invest in new, original films with bigger budgets and star power. But some AVODs like The Roku Channel and Crackle are starting to produce their own high-quality originals to compete.

Can I make money as a filmmaker with AVOD?

It’s possible, but hard. Most AVOD platforms pay flat licensing fees-often $5,000 to $20,000-for indie films. You won’t earn royalties from ads. To make real money, you need to license to multiple platforms, promote your film aggressively, and ideally, get it picked up by a distributor with better deals.

Will SVOD disappear because of AVOD?

No. SVOD still dominates premium content. People pay for ad-free experiences, exclusives, and binge-worthy originals. But SVOD will shrink. More users will drop to hybrid or ad-supported tiers. The future belongs to services that offer both options-like Paramount+ and Hulu-so viewers can choose how they want to pay.

Comments(9)